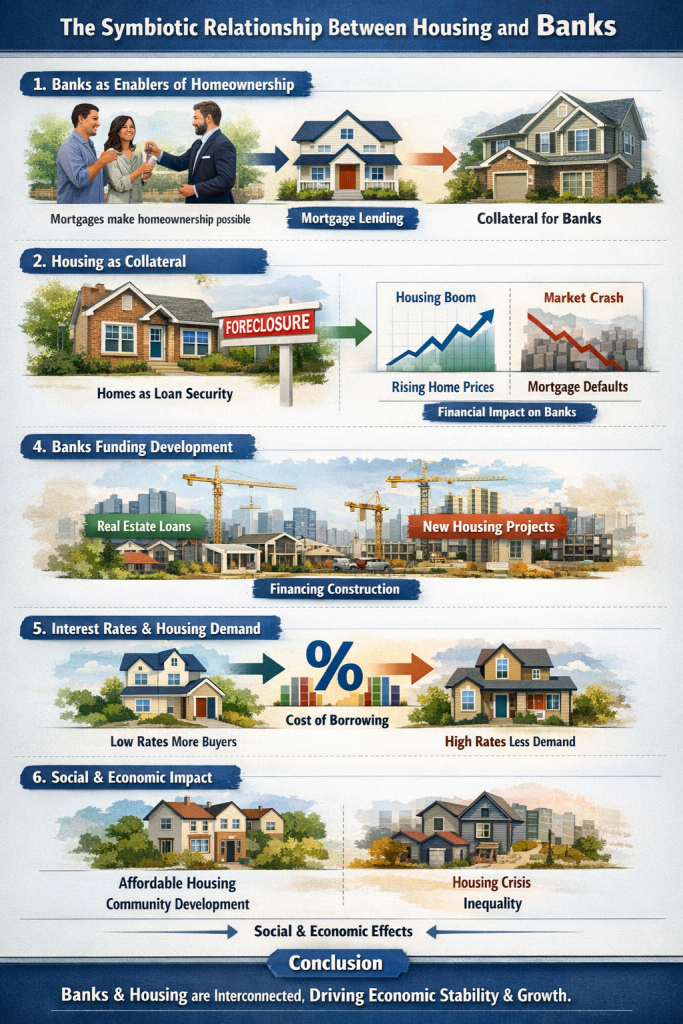

The housing sector and the banking industry are two pillars of any modern economy. Their relationship is deeply intertwined, with banks playing a central role in facilitating home ownership and the housing market influencing the financial health of banks. Understanding this relationship is key to appreciating how economies grow, how households build wealth, and how financial stability is maintained.

1. Banks as Enablers of Homeownership

One of the most direct ways banks influence housing is through mortgages. Mortgages are loans provided by banks that allow individuals and families to purchase homes without paying the full price upfront. Without access to bank financing, homeownership would be limited to the wealthy few who can afford to buy homes outright.

Banks assess borrowers’ creditworthiness, income, and financial history to determine eligibility for loans. By extending credit responsibly, banks enable more people to buy homes, which fuels demand in the housing market. This, in turn, can stimulate construction, create jobs, and generate economic growth.

2. Housing as Collateral and Bank Security

Homes often serve as collateral for loans. This means that if borrowers fail to repay their mortgage, banks have the right to repossess the property. This security reduces the risk for banks, allowing them to lend more aggressively. Collateralized lending is a cornerstone of the modern banking system, and housing plays a central role in this mechanism.

3. The Housing Market and Bank Stability

The performance of the housing market can directly affect the financial health of banks. Rising home prices generally increase the value of bank assets and reduce default risk. Conversely, a housing market downturn can lead to rising mortgage defaults, which can hurt banks’ balance sheets. The 2008 global financial crisis is a stark example of how housing and banks are interconnected: mortgage-backed securities and falling property values led to a cascade of bank failures and financial instability worldwide.

4. Banks Driving Housing Development

Banks not only lend to individuals but also provide financing to developers and construction companies. Large-scale housing projects often require loans for land acquisition, construction, and infrastructure development. By funding these projects, banks help expand housing supply, which can stabilize prices and make homes more accessible.

5. Interest Rates, Housing, and Lending Behavior

The cost of borrowing—dictated by bank interest rates—affects housing affordability and demand. Lower interest rates make mortgages cheaper, encouraging more people to buy homes, while higher rates can dampen demand. Central banks and commercial banks alike play a significant role in shaping housing market dynamics through monetary policy and lending practices.

6. Social and Economic Implications

The interaction between banks and housing extends beyond economics. Affordable housing financed through banks can contribute to social stability, reduce homelessness, and support community development. Conversely, restrictive lending or housing bubbles can exacerbate inequality and financial stress.

Conclusion

The relationship between banks and housing is mutually reinforcing. Banks provide the financial tools necessary for homeownership and housing development, while the housing market provides security, growth opportunities, and economic signals that impact banking decisions. Policymakers, investors, and homeowners alike must understand this dynamic to foster a stable, equitable, and prosperous economy.